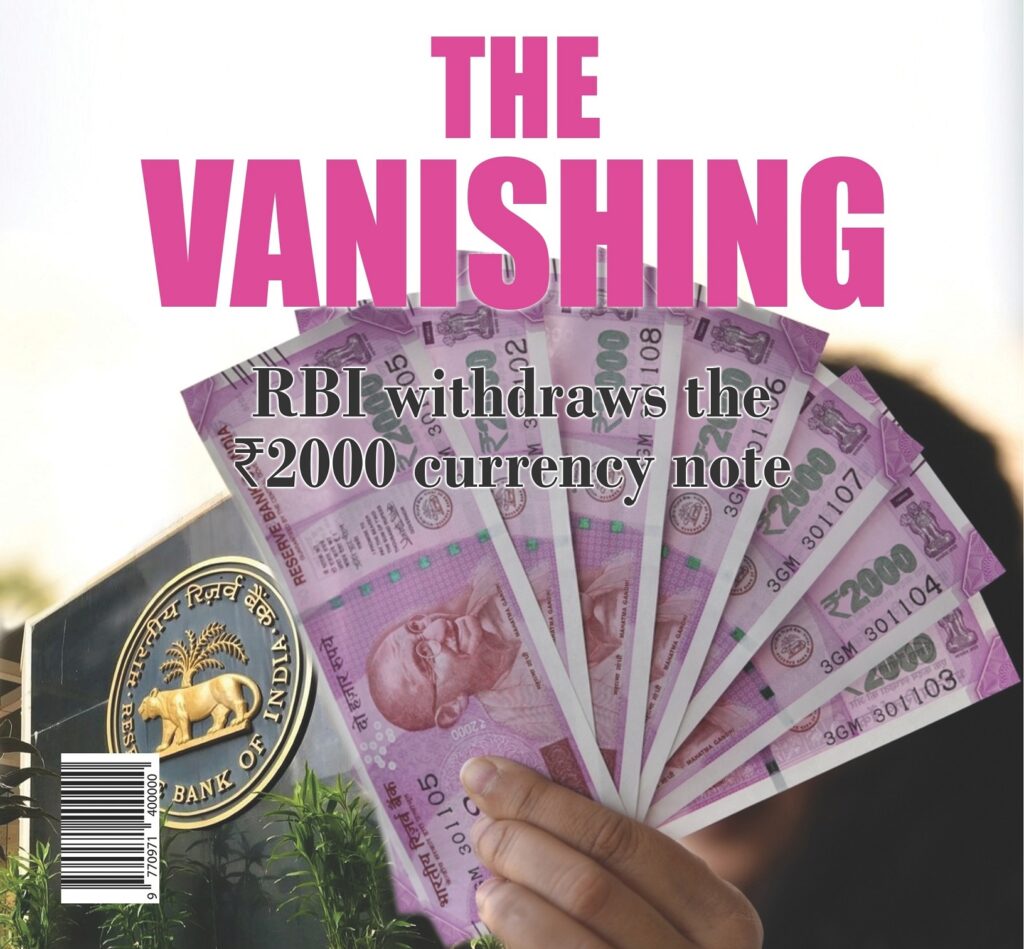

Arshad Shaikh studies the recent announcement by the RBI to withdraw the ₹2000 currency note from circulation. While the RBI says that it is a routine exercise, many see it as one more opportunity created for the government to score brownie points before the general elections by projecting as the second surgical strike on black money. As the scars of the 2016 demonetisation are yet to heal, critics have come down hard on the decision and called it needless and creating more confusion than clarity. Sadly, very few focus on the impact of its withdrawal on the economy, which needs healing rather than strikes and blows.

The Reserve Bank of India (RBI) has announced that it will withdraw the ₹2000 denomination banknotes from circulation. Unlike demonetisation, this time around, the notes will continue as legal tender. However, the RBI circular said, “To complete the exercise in a time-bound manner and to provide adequate time for the members of the public, all banks shall provide deposit and/or exchange facilities for ₹2000 banknotes until September 30, 2023.”

The ₹2000 currency note did not exist earlier. It was introduced during demonetisation in November 2016 to “meet the currency requirement of the economy in an expeditious manner after withdrawal of the legal tender status of all ₹500 and ₹1000 banknotes in circulation at that time.” RBI stopped printing them since 2018-19, and they are at the end of their “estimated life-span of 4-5 years.”

India’s Central Bank says that its withdrawal shall have no negative impact on the economy as “the stock of banknotes in other denominations continues to be adequate to meet the currency requirement of the public”.

Moreover, the ₹2000 was not commonly used in daily transactions. It is estimated that it constitutes around 10-11% of all cash in circulation. The main reason cited by the RBI for the phasing out of the ₹2000 note is the “Clean Note Policy”. As can be made out by its name, the policy aims at ensuring the availability of “good quality banknotes to the members of the public.”

FODDER FOR THE SPIN-DOCTORS

The advocates of the demonetisation of the ₹500 and ₹1000 currency notes point out that it was aimed at curbing black money, counterfeit currency, and corruption in the country. Many would argue that none of these objectives was met. Still, the move was touted as a masterstroke and a surgical strike on black money. The same story is being repeated today. Veteran BJP leader from Bihar, Sushil Modi told the media – “This is the second surgical strike on black money. During demonetisation, the government started printing ₹2000 notes to give immediate relief to the people. This will not trouble the common man as they do not have ₹2000 note.”

Although leaders from the ruling party and ministers of the government have underplayed the decision, they are bound to exploit the decision at the time of campaigning for elections. Talking to a leading TV Channel, former Chief Economic Advisor (CEA) of India, K Subramanian said, “If we look at the amount of money in circulation, in ₹2000 notes, as of March 2018, the amount of ₹6.7 lakh crores. Today, as per RBI data, that amount has come down to ₹3.6 lakh crores. It means that the residual amount, which is ₹3.1 lakh crores, has been hoarded in stashes by various individuals (as black money).”

The former CEA also defended the decision of the RBI to “exchange ₹2000 banknotes up to a limit of ₹20,000/- at a time”, saying, “The key economic motive behind this is to bring out the hoarded cash.” One must recall that this was the same spin given to justify demonetisation. However, contrary to the claims of the government and proponents of demonetisation, a significant portion of the demonetised currency was ultimately returned to the banking system, suggesting that most of the black money was held in forms other than cash.

As affirmed by RBI data, almost the entire chunk of money (more than 99%) that was invalidated by demonetisation came back into the banking system. Of the notes worth ₹15.41 lakh crore that were invalidated, notes worth ₹15.31 lakh crore were returned to the banking system. There is no reason history will not repeat itself.

WIN-WIN FOR BANKS

It cannot be denied that the RBI wanted to reduce the high-value notes in circulation by ceasing to print the ₹2000 notes in the last four years. This made sense as the higher the denomination, the easier is it to store money as cash. With the government, pushing for a cashless economy the move for withdrawal can be seen in that light. If we assume that the use of cash jumps before elections, then the timing of the withdrawal assumes significance. Thus, those who stashed cash in the form of ₹2000 notes for the upcoming state and general elections in the country may be in trouble.

What impact will the withdrawal have on the economy? Experts say that the impact will not be significant because it makes up approximately only 11% of the currency in circulation.

In addition, the usage of digital transactions (UPI payments) and e-commerce has seen a huge increase in recent times. Once again, banks will be the biggest winners in this exercise. With a huge spike expected in the deposits of banks (as people will rush to exchange their ₹2000 notes for smaller denomination notes), the pressure on banks to maintain high-interest rates will ease significantly. This will have a cascading impact and improve the “banking system liquidity”.

THE NEED TO BENEFIT ALL

Managing money is one of the most important tasks of the government. We must have a polity where major policy decisions are made only after due diligence and a broad consensus is reached with the concerned stakeholders. The most important stakeholder is the common citizen. It is very rarely that his/her interests are taken seriously.

Moreover, the decision-makers must be held accountable for their acts of omission and commission. This process of accountability is severely compromised in illiberal democracies.

American retired biomedical researcher and a Libertarian speaker, writer, and activistMary Ruwart correctly points out, “As long as government has the power to regulate business, business will control government by funding the candidate that legislates in their favour. A free-market thwarts lobbying by taking the power that corporations seek away from government!

“The only sure way to prevent the rich from buying unfair government influence is to stop allowing government to use physical force against peaceful people. Whenever government is allowed to favour one group over another, the rich will always win, since they can “buy” more favours, overtly or covertly, than the poor.”

₹2000 banknotes will soon vanish from circulation. Will it help in reducing corruption, black money and counterfeit currency?

There is a quote attributed to Henry Ford who said, “It is well enough that people of the nation do not understand our banking and monetary system. For if they did, I believe there would be a revolution before tomorrow morning.”